One main component of Louisiana Governor Jeff Landry’s tax reform plan is a flat tax on incomes higher than $12,500. Whether or not that’s a good idea depends on who you ask. Jan Moller, the executive director of Invest in Louisiana, is among those opposed to the idea. Moller says that would cost the state more than a billion dollars in lost tax revenue and would have a devastating impact. “Are we gonna have enough money to pay for healthcare, to pay for public schools, to pay for infrastructure and all of the things that taxes pay for. Our early indication is it’s going to lead to budget cuts.”

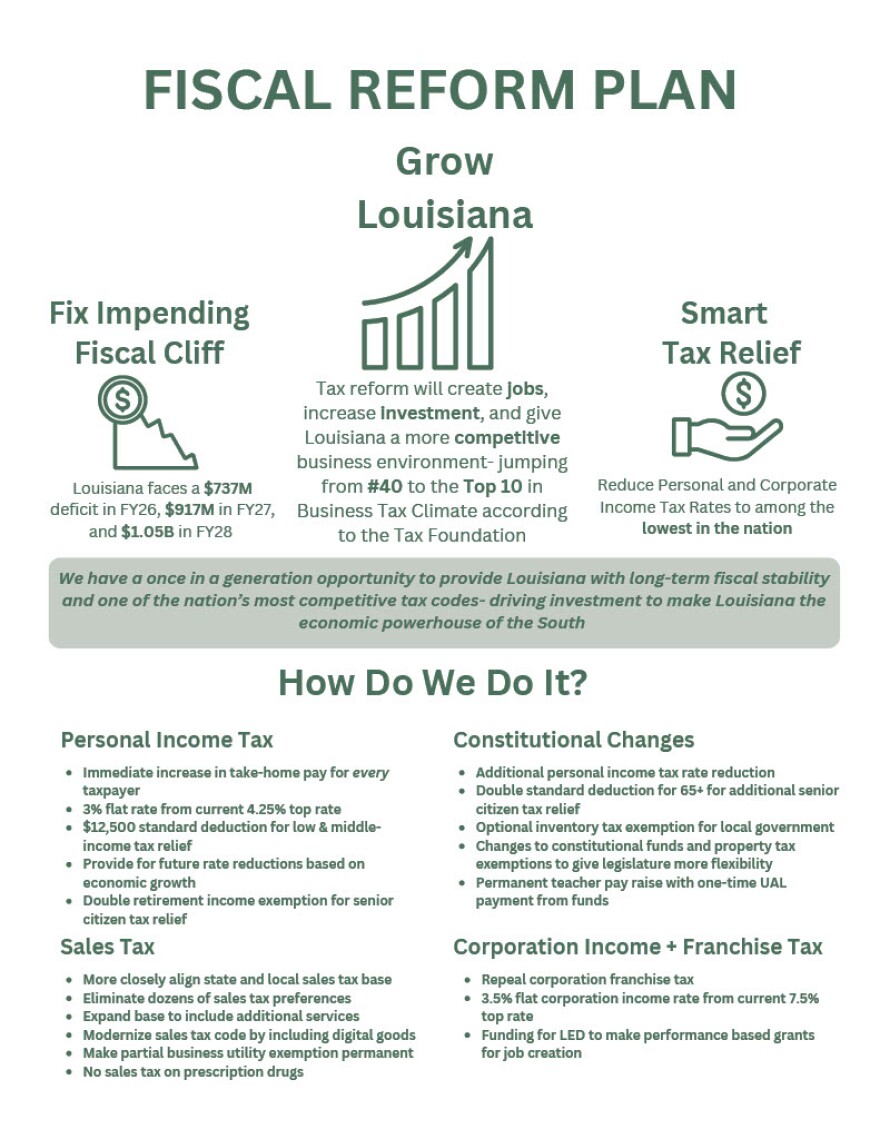

Landry’s plan would make up that lost tax revenue by taxing services that are not currently being taxed. Daniel Erspamer, the CEO of the Pelican Institute, says dropping income and corporate taxes will increase jobs. “This can create up to two billion dollars in economic activity and create at least five thousand new jobs just in the first year alone. And then we’ll keep working to fade that rate down over time.”

Landry and lawmakers are expected to meet for a special session in Baton Rouge next month.